Copy Forex Trading is revolutionizing the way individuals invest in the foreign exchange market. By leveraging the expertise of seasoned traders, newcomers can navigate the complexities of forex trading with greater confidence and less risk. This innovative approach allows traders to replicate the strategies of successful investors, thus maximizing their potential for profit. For more information on forex trading strategies, you can visit copy forex trading https://trading-uganda.com/.

Understanding Copy Forex Trading

Copy Forex Trading, also known as social trading or mirror trading, is a method where traders can copy trades made by successful investors in real-time. This approach is particularly appealing to beginners who may lack the knowledge or experience to make informed trading decisions on their own. By observing and mimicking established traders, novice investors can reduce their learning curve and potentially increase their profitability.

The Benefits of Copy Forex Trading

- Accessibility: Copy Forex Trading enables anyone to participate in the forex market, regardless of their prior experience. This democratization of trading means that individuals with varied backgrounds can engage in this potentially lucrative market.

- Learning Opportunity: By observing how successful traders approach their trades, less experienced investors can gain valuable insights. This exposure can accelerate their learning process and enhance their understanding of market dynamics.

- Diversification: Copying multiple traders allows individuals to diversify their investment portfolios easily. By following various strategies, traders can spread their risk and potentially minimize losses.

- Time-Saving: For those who may not have the time to dedicate to market research and analysis, Copy Forex Trading provides a practical solution. They can leverage the expertise of others while still maintaining an active role in their investments.

How to Get Started with Copy Forex Trading

Embarking on a Copy Forex Trading journey involves a few key steps that can set you up for success:

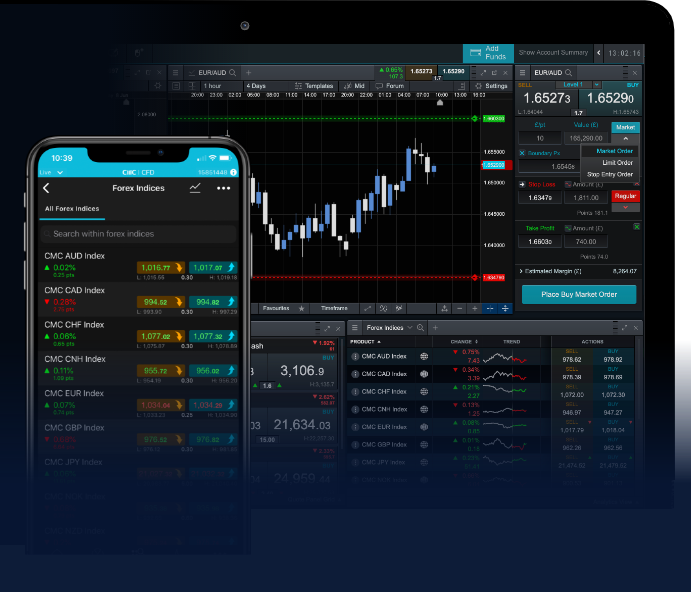

- Choose a Reliable Platform: Selecting a trustworthy trading platform that offers copy trading features is crucial. Look for platforms with strong security measures, user-friendly interfaces, and a wide selection of traders to follow.

- Research Traders: Take the time to analyze the performance of potential traders you may want to copy. Look for those with consistent results, a proven track record, and trading styles that align with your risk tolerance and investment goals.

- Set a Budget: Determine how much capital you want to allocate to your copy trading endeavors. It’s essential to only invest what you can afford to lose and to establish clear risk management strategies.

- Monitor and Adjust: After selecting traders to copy, it’s essential to monitor their performance. Be prepared to adjust your portfolio by changing whom you follow based on their performance or shifts in your investment objectives.

Risk Management in Copy Forex Trading

While Copy Forex Trading offers numerous advantages, it is not without its risks. Here are some essential risk management strategies to consider:

- Diversification: As previously mentioned, diversifying your investments by copying multiple traders can help mitigate risk. Ensure these traders employ different strategies to balance potential losses with gains.

- Set Stop Losses: Many trading platforms allow users to set stop-loss orders, which automatically close trades when they reach a predetermined loss threshold. This can protect your investment capital from excessive losses.

- Regular Reviews: Consistently review the traders you are copying to ensure they continue to meet your expectations. If their performance declines or their risk profile changes, consider adjusting your strategy accordingly.

- Educate Yourself: The more you understand forex trading, the better equipped you will be to make informed decisions. Consider taking education courses or webinars to enhance your knowledge.

Common Mistakes to Avoid in Copy Forex Trading

Even with the advantages of Copy Forex Trading, beginners can still fall into common pitfalls. Here are some mistakes to avoid:

- Overreliance on Copying: While it can be tempting to rely solely on the strategies of others, it’s essential to develop your understanding of the market. Make your own adjustments and decisions based on your research.

- Ignoring Market Conditions: Traders perform differently under various market conditions. Ensure you stay informed about economic events and shifts in market sentiment that could impact the strategies of the traders you follow.

- Pursuing High Risk for High Reward: Many novices seek out high-risk traders hoping for rapid gains. However, this approach often leads to significant losses. It’s vital to balance risk and reward and choose traders whose strategies align with your risk tolerance.

- Failure to Diversify: Copying just one or two traders can expose you to substantial risks. A diversified portfolio helps protect against the poor performance of any single trader.

The Future of Copy Forex Trading

As technology continues to advance, the landscape of Copy Forex Trading is expected to evolve. Innovations such as artificial intelligence and machine learning may provide traders with more sophisticated tools for analyzing market trends and automating the copying process. These advancements could lead to even greater accuracy in trade replication and potentially higher profits.

Furthermore, as the global market becomes increasingly interconnected, more individuals will be drawn to the convenience and accessibility of Copy Forex Trading. As this trend progresses, expect to see an influx of new traders eager to leverage the expertise of others while navigating the complexities of the forex market.

Conclusion

Copy Forex Trading presents an exciting opportunity for traders of all experience levels. By harnessing the skills and strategies of successful investors, novice traders can embark on their trading journey with more confidence and less risk. However, it is critical to approach this method with a sound understanding of the market and effective risk management practices. As you explore the world of Copy Forex Trading, remember to keep learning, stay informed, and adapt your strategies to maximize your potential for success.